APAC Climate Risk: Policy, Next Steps and the Road Ahead

June 17, 2022

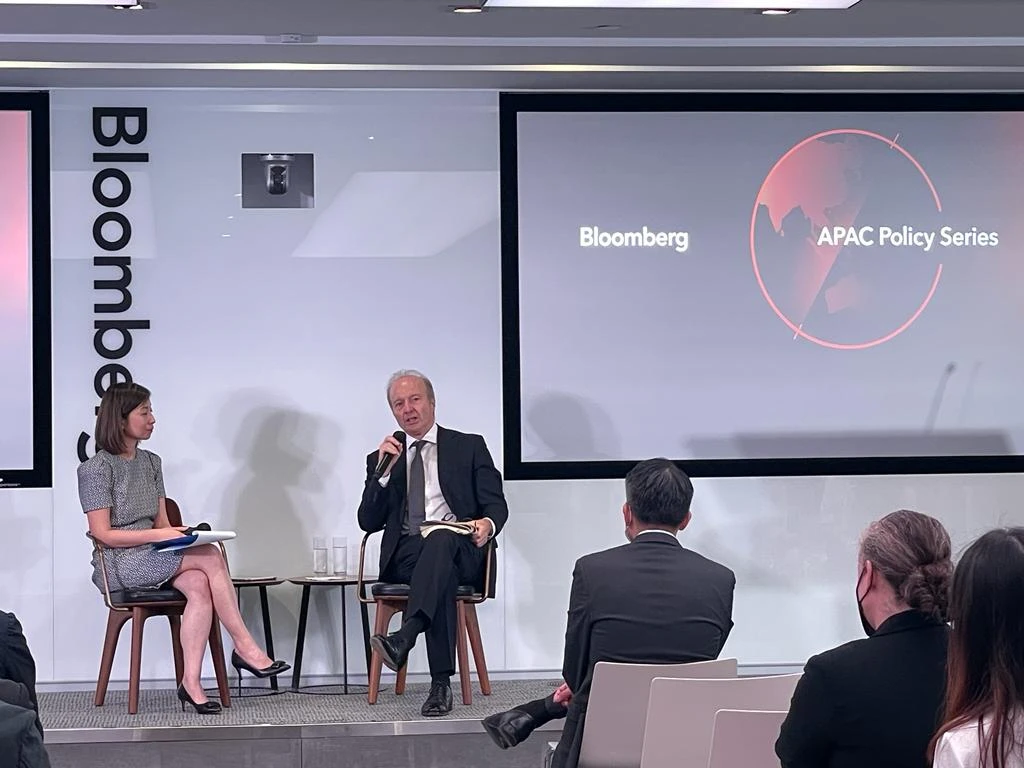

The Chair of International Organization of Securities Commissions and the CEO of Hong Kong Securities and Futures Commission, Ashley Alder, came to Bloomberg’s offices to share practical insights on tackling climate risks in the Asia-Pacific.

Bloomberg hosted the first of its APAC Policy Series of events where Ashley Alder, Chair of International Organization of Securities Commissions (IOSCO) and CEO of the Hong Kong Securities and Futures Commission (SFC), addressed the urgency in tackling climate risks with a focus on the carbon markets. He discussed new policies and regulations, addressed constraints on data availability, consistency of disclosures and identified specific opportunities and challenges of climate reporting in the region.

In the panel discussion with Vicky Cheng, Head of Government and Regulatory Affairs, Asia Pacific Bloomberg, Alder also shared his vision on the carbon market and associated challenges including quantifying the quality and credibility of carbon credits, low prices and thin trading, all of which made it a less effective tool to rein in emissions. He felt that Hong Kong can certainly play a bigger role in developing a centralized and on-exchange voluntary carbon market, so buyers of carbon credits from Mainland China have an additional and transparent purchase channel.

Alder also urged the industry to take action by making an assessment of the demand, should there be a strong appetite for local carbon market development. While regulators can help provide the necessary framework and infrastructure, the drive also needs to come from the real economy, supported by financial flows from investors.

Getting Serious about Climate Reporting

Kicking off the event, Alder recapped points from his COP26 speech on the distinction between climate finance and ESG in the context of sustainable finance. He also shared the ‘climate first’ focus among global regulators at IOSCO, where they are trying to put in place far more accurate and consistent global yet locally implemented measurement tools to tackle greenwashing concerns which he noted, “have increased quite substantially over the last few months.”

The formation of the International Sustainability Standards Board (ISSB) and Glasgow Financial Alliance for Net Zero (GFANZ) at COP26, was the “easy part” compared to the more complex work of implementation. He shared the common observation that measuring ESG muddles two things – first, an objective assessment around risk and opportunity, and second, around values and ethics, which Alder commented “is the problem around ESG as a whole, and we have not got to a stage where there are very convincing answers to that dilemma.”

He added, “As well as the genuine push to provide corporates and the financial sector with measuring tools and data to tackle climate and transition, the regulatory community is, at the same time, ramping up its focus on greenwashing”, putting us at an “inflection point.”

Turning to asset managers and their use of ratings, Alder acknowledged there were “concerns” around current methodologies, data and consistency behind ESG ratings and that it is “a component of potential greenwashing.” He said he is looking at more detailed best practices, particularly legal remits, to cover the activities of ESG ratings agencies.

“We know that, whether it’s an asset manager, insurer, or bank, all the intermediary activity is almost entirely dependent on reliable, credible, corporate real-economy level data, and that is the reason why the global community of regulators have concentrated so much on the ISSB initiative.” he said. Cognizant of the difficulties asset managers face when assessing ESG ratings for use in their investment decisions, “the best that you can do currently is internal quality control around methodology as well as data as they relate to products, funds or strategies. It ultimately boils down to due diligence.”

Consistency of Standards is Critical

Alder also stressed that the convergence of standards and standard setters was incredibly important, revealing that the single ask from investors was to “simplify the many standards and disclosures, because it causes an inability to make reliable investment decisions.” That is why there is a strong regulatory push for the ISSB recommendations, a set of disclosure standards for corporates that are “a fundamental building block of the ESG ecosystem.”

Speaking about the importance of the IOSCO Sustainable Finance Taskforce’s (STF) corporate reporting workstream, he said the outcome of the assessment by IOSCO of the ISSB standards was going to be critical, because that should result in “an endorsement of those standards to inform our membership (IOSCO member jurisdictions), allowing the industry to bridge global standards to local implementation.”

He also stressed that we should “ensure that ISSB standards, US standards and EU standards don’t compete with each other,” and that “sufficient compatibility is important to achieve a useful global baseline reporting standard.”

Taking an example of a Hong Kong listed company that has business in Mainland China, he said, “We do not want to get into a situation where a company is subject to different sets of requirements of reporting. To tackle this, a working group between Hong Kong and Mainland financial regulators has been set up to discuss the use of broader data estimation tools and proxy data to help determine the accuracy of climate disclosures.”

Immediate Challenges & Constraints

Alder listed several key challenges that needed to be addressed to ensure a successful global baseline. He said it starts with the importance of data availability within different industries, and their technical capability to handle those disclosure expectations. There is also the need to adopt a proportionate approach to regulation for SMEs in relation to disclosure requirements and to develop an appropriate assurance framework for sustainability disclosures. He also highlighted the importance of being more precise about the relationship between climate disclosures and traditional financial statements. Alder also reiterated the need for a clearer link between climate reporting and net-zero commitments.

On standard setting, he said that if there isn’t enough guidance on the ‘how to’ compared to the ‘what’ regarding disclosures, there will be challenges for consistent implementation. Jurisdictions may need guidance to think through what are the key considerations for phasing in the ISSB standards amid capacity and data constraints, Alder offers a view to “first take the standards which have the highest impact and are relatively easy to comply with.”

Painting a bigger picture, Alder shared that the EU’s global contributions to emissions are around 8-11%, with Asia accounting for 50% and China by itself accounting for 30% of the global total. “If you don’t solve the Asia issue, you won’t solve the problem,” he said.

To watch a replay of the discussion, please visit this link.